Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

Real estate: Paris remains a safe haven for investors

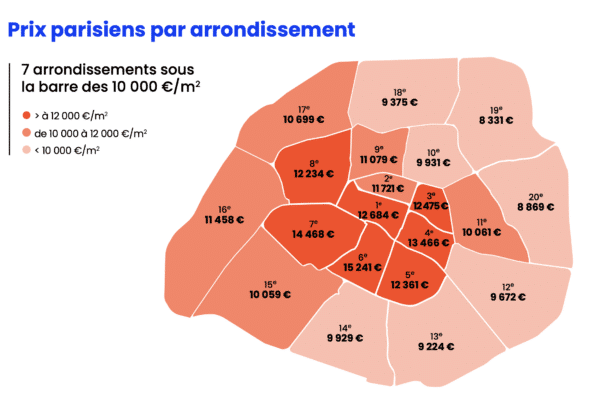

In Paris, rental investments represented 32.3% of transactions in the first half of the year Paris real estate still attracts those who wish to buy rental property, despite an average square meter price that exceeds 10,000€. Because, in the capital, the purchase has other advantages than profitability.

Paris, city of investments and pied-à-terres… This is the observation drawn by the network of Century 21 real estate agencies, which notes that rental investments represented 32.3% of transactions in the first half of the year. A record, confirmed by many professionals, despite historically high prices (€10,750/m2 on average according to data from the Paris Chamber of Notaries). Julien Guillaume, president of the Paris Left Bank and South Paris region agency group at Orpi, observes:

“In the capital, we invest in real estate like we buy gold. Buyers know that it is expensive, but that, in the long run, they will win out. The people who come to see us are small wealth investors. They have one or two apartments and are looking to rent studios or 2-room apartments near stations. Most of the time, they buy thinking that these homes will later serve as a base for their children when they go to school. ”

Because, if returns are low in the capital, buying to rent has many other advantages. “What investors pay for is peace of mind,” notes Michel Platero, president of Fnaim du Grand Paris. “You are sure to have tenants. The imbalance between supply and demand is such that your accommodation will always be occupied, and therefore you will receive your rents continuously, which is not the case in all cities in France.”

The rent control, so decried by real estate agents when it came into force two years ago, does not seem to scare away landlords. As confided by many professionals, the measure essentially disadvantages investors who rent large apartments (greater than 50 m2) as the gap between the purchase price of the property and the rents collected is significant. In addition, as Meilleurs Agents indicated in a study published in June 2021, nearly one out of two ads in Paris does not comply with rent controls. Three-quarters of apartments of less than 20 m2 are even offered at prices above the management reference threshold, with rent surpluses ranging from 100€ for a bare apartment to 130€ for a furnished apartment.

Still, it is not impossible to marry respect for the law and smart investment in Paris. “You have to be a strategist,” emphasizes Fabrice Artinian, financial investment advisor for the Patrimmofi group.

“Investors should bet on apartments of 30 to 40 m2, preferably unfurnished studios of good quality. The ceiling set by the rent control differs little from what could be found before on the market, especially if the property has a balcony. The ideal is to find accommodation in the 13th, 14th, 15th, 16th or 17th arrondissements, preferably below the 12,000€/m2 mark. Even taking into account the condominium fees, we arrive at a rental yield between 2% and 3% gross, but, above all, we can obtain a nice capital gain when reselling. ”

Provided you invest in housing that is not an energy sieve in a building that does not require major renovations. “Even if the MaPrimeRénov’ system helps landlords to carry out work, it is still not enough. If you buy an apartment in a Haussmannian building, the insulation of the walls can only be done from the inside, which implies a very high cost”, recalls Fabrice Artinian.

Source: L’OBS

Contact Paris Property Group to learn more about buying or selling property in Paris.