Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

Taxes in France: Changes benefit foreign buyers, cause French to flee

The French press is abuzz with stories about 1+ million euro properties hitting the Paris real estate market in recent weeks as a result of looming tax-hikes. What does this mean for the non-resident Paris lover ready to invest in a Paris pied-a-terre? Could it be a short-term buying opportunity? Paris Property Group takes a look at the silver lining for foreign buyers.

More choice properties on the market.

France’s socialist government has just released it’s proposed 2013 fiscal law. Provisions include raising the income tax to 75% for residents earning over 1 million euros, and an increase in capital gains tax assessed on the sales of stock and company stakes. These changes are pushing a number of those affected by that change to abandon their residency in France, according to Didier Bugeon, head of wealth manager Equance. And a survey of Paris realtors reports that 400 1+million euro properties in Paris have been listed for sale in the last weeks.

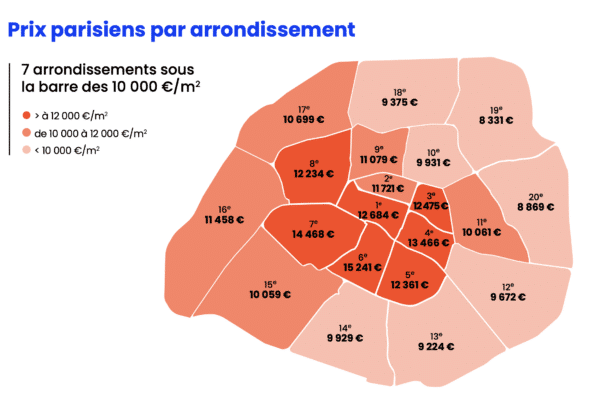

The number of sales in Paris was down 20% in the first half of 2012 as compared with the same period last year; prices stayed steady or risen slightly. A growing number of properties for sale in the Paris market should steady – or soften – prices while offering a more interesting selection of apartments to choose from. For any buyer, this change is welcome; second home buyers looking for a pied-a-terre in France are particularly well-poised to benefit.

Why?

- Non-resident owners are not subject to French income tax so this burden does not apply to them.

- French wealth tax can be minimized or avoided entirely by securing a mortgage on the property to keep its book value under €1.3 million. There is no wealth tax assessed if the total assets are less than €1.3 million. The starting rate from there is 0.025%, or €3,200 – hardly disastrous given that property taxes in Paris are much lower (.1 to .3 percent) than in most places (in the US, 1 to 3 percent property taxes are common). In most cases the new wealth tax is still generally under 1%.

- Current capital gains tax rates and reduction schedules (extending to 30 years ownership for full relief from capital gains tax) are likely to be altered or undone long before a current buyer wants to sell. Because of the relatively high closing costs in France, the market here does not lend itself to flipping properties for speculative gain. What’s more, the last year alone has seen two substantial changes to capital gains tax law; the 2013 fiscal law already proposes a third, with others under discussion. So if you are buying a property that you intend to enjoy for some years to come, tomorrow’s capital gains tax rules shouldn’t really make a big difference in your decision to buy today. And, with high closing costs in France, if you DO need to sell sooner, you probably aren’t going to have racked up huge gains anyway.

The reasons to invest in Paris remain sound and provide an opportunity for savvy investors to take advantage: Paris is a safe, long-term investment with historic property value gains of 10% per year over the past 40 years. And in the end, there really is no substitute for sitting on your very own balcony drinking a glass of rosé after an enjoyable day taking in the sights of Paris.

Contact Paris Property Group to learn more about buying or selling property in Paris.