Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

Loi de finances 2020: which measures will affect real estate in France?

This year’s Loi de finances includes many measures of interest to the real estate sector. Certain real estate tax cut programs already in force will be extended and modified, while tax reforms continue to change the financial landscape for homeowners. Read ahead for everything you need to know about this year’s changes.

Le dispositif Pinel

Under certain conditions, le dispositif Pinel grants an income tax break to individuals who either purchase or build new or like-new properties before December 31, 2021, with the goal of renting them out. Tax cut percentage rates, which are based on the cost price (within certain limits), vary according to how long the investor plans to rent out the property (12% for 6 years, 18% for 9 years or 21% for 12 years).

For purchases in 2021, only those who purchase new or like-new spaces within apartment buildings or other such collective living spaces, and not individual houses, will be eligible for the tax cut.

Note: a trial run with the new eligibility rules has been launched in Brittany. The definitive list of those cities affected by the change, as well as details concerning rent caps and tenant income, will be determined by order of the regional prefect.

Le dispositif Denormandie

The Denormandie program aims to encourage investors in the purchase and renovation of dwellings in city and town centers whose real estate offerings are in dire need of some help. Investors then benefit from an income tax break based on the same specificities as that of Pinel, just so long as renovation costs are at least 25% of the total purchase cost of the property.

Besides its extension until December 31st, 2022, Denormandie is also undergoing some modifications. The very notion of what defines the “center” of these cities and towns, which was not only difficult to define and generated uncertainty amongst investors, but restricted the program from gaining ground, has completely changed. As of January 1st, 2020, Denormandie is applicable throughout the entirety of all eligible cities and towns, and not just in the center.

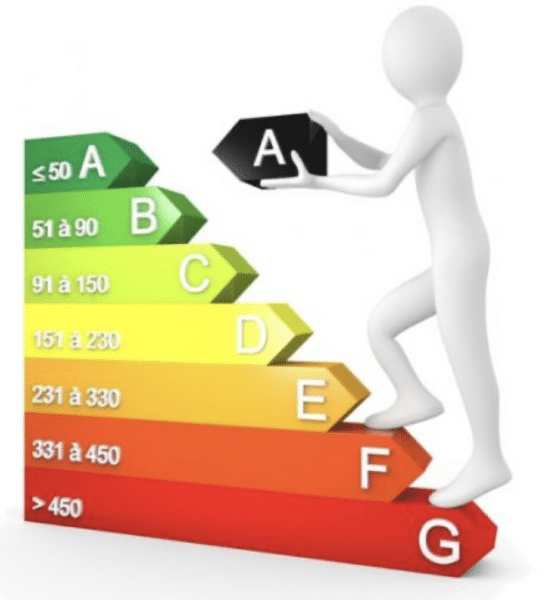

CITE

The crédit d’impôt pour la transition énergétique (CITE), which grants tax credits to homeowners making energy improvement renovations in their primary residence, will now be granted to low-income households in the form of a flat-rate bonus. The aim is to refocus financial efforts by the State in favor of France’s most modest households. Distributed directly by the Agence Nationale de l’habitat (ANAH), or France’s National Housing Agency, the terms and conditions of the bonus will soon be fixed by decree. Starting January 1, 2021, however, this lump-sum premium should be available to households of all income levels, except the most well-off.

Pending this deadline, the CITE has been extended until December 31, 2020, for so-called “intermediate” income households. The program is also subject to change: the list of eligible expenses could be revised, a lump sum tax credit by type of expenditure could be introduced, etc.

Le Prêt à Taux Zéro

Subsidized by the State, the Prêt à Taux Zéro is a zero interest loan granted to buyers meeting certain income requirements in certain areas of the country, to help partially finance their real estate acquisition. Although government officials have agreed on the extension of the program until December 31st, 2021, the Loi de finances 2020 has further restricted its terms and conditions. As of January 1st, 2020, you can no longer obtain the PTZ for new housing in zones B2 and C. As for pre-existing housing, no changes have been made, and the program is still applicable until 2021.

Valeurs locatives

Valeurs locatives represent a theoretical annual rent level that a given property could produce if it were to be rented out. It is one of the criteria used to calculate housing and property tax. This year, “rental values” are being updated for the first time since 1970. The process will take place in two stages: Before July 1, 2023, lessors will have to submit information pertaining to the current amount of the rent they charge in order to determine the new rental value of the property. In 2026, local values will be updated to calculate various taxes, primarily property and housing taxes, which are expected to rise substantially. To avoid sticker shock, gradual increases will be implemented.

Taxe d’habitation

Implemented in 2018, France’s housing tax, or taxe d’habitation, reform continues its advance in 2020. This year, it is accompanied by rental value reforms, which serve as the basis for the tax’s calculation.

According to 2020 finance laws, to benefit from a housing tax exemption, the amount of your taxable income, or revenu fiscal de référence must be below €27,706 for the first unit (1 unit = 1 adult household). This ceiling is increased by €8,209 for the next two half-units, and by €6,157 from the third half-unit onwards.

If your revenu fiscal de référence exceeds the ceiling but remains below €28,732 for the first unit, the finance bill provides for an allowance. Housing tax will eventually be phased out by 2023, except for vacant dwellings and second homes.

Sources: Loi de finances 2020 : les mesures concernant l’immobilier; LA LOI DE FINANCES 2020 : CE QUI CONCERNE L’IMMOBILIER

Contact Paris Property Group to learn more about buying or selling property in Paris.