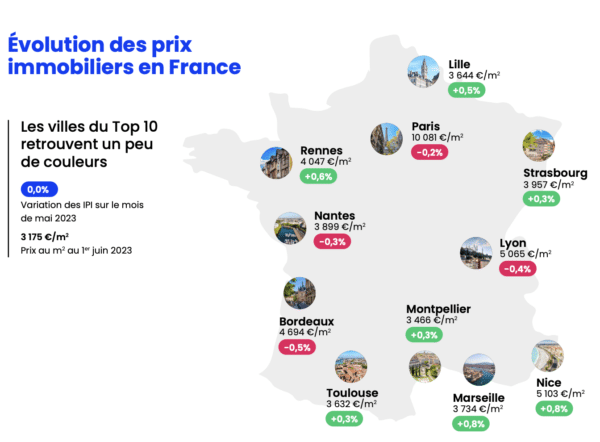

Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

How many years does it take to see a return on your Paris rental investment?

A new map illustrates how many years it would take to earn back the purchase price of a Paris apartment by each metro station; the most profitable investments are not where you might think they’d be.

The highest rents in Paris can be found in the centre, with 2-bed flats reaching around €1000-1400 in the central arrondissements. But a recent map of rental returns by metro station shows that the comparatively larger upward trend in property prices means that if you are seeking a buy-to-let investment, look outside the centre – at least for long term rental investment income.

Rent-to-price ratios increase – and the years required to earn back your investment decrease – in the peripheries of the city. By the ends of the 7, 5 and 3 metro lines, your buy-to-let investment would take only around 15 years to cover your purchase cost through rent accrued. In 6th and 7th arrondissements this period more than doubles, with stations like Cite, Saint-Germain-des-Pres, Invalides, Champs Elysee Clemenceau and Solferino showing figures of well over 30 years.

Metro stations in arrondissements sought-after by young professionals (Bastille, Republique, Parmentier, Oberkamf etc.) in the 10th and 11th arrondissements show an average of about 20 years, with this figure rising the more westward you go (and falling to the east and north). Prices are also growing fast here and tenants will present themselves in abundance.

In reality, it might not be such a straightforward dichotomy between center and periphery. Rents in the city center can be substantially higher than official records show, especially if the property is being renting for short term vacation purposes. Short term rentals can easily earn double what a longer term rental would earn.

The map is below; click here for a zoomable version.

How many years for for your rental investment to break even?

Most talk of rental investment mentions rental yield (where these year-figures are derived) since buy-to-let investors don’t usually seek to wait until the purchase price has been covered from rental income before selling off. Market fluctuations can see rents rise or fall, and an apparent peak in the market will often prompt a sale.

Government policy is also certainly playing a role here. With a cap on rents but no cap on prices, the latter has grown faster than the former. This means while you will pay four or five times more for a property in the centre, you won’t be able to charge four or five times more to rent it out on a long term basis. This suggests that buyers are staking most of the investment value on appreciating price valuations, or on short term rental investment income.

Learn more about pricing by neighborhood in Paris.

For more information on how to optimize your potential investment in Paris real estate contact@parispropertygroup.com

© Wikicommons

Contact Paris Property Group to learn more about buying or selling property in Paris.