Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

French real estate: a market just waiting for buyers.

The month of February confirms a slowing down in the decline of prices seen over the first thirty days of the year. At least for some parts of the country. Prices in the top 10 cities continued to fall over the past month (-0.1%), but at an increasingly slower pace. For the record, France’s ten biggest cities lost -0.2% in December and January.

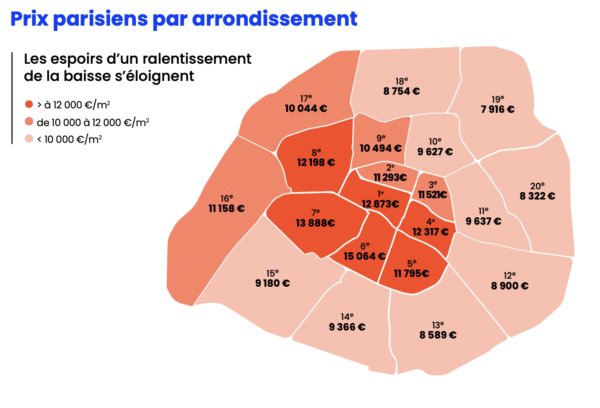

Paris continues to fall, with -0.7% in February (-6.6% year-on-year), a monthly rate of decline even higher than last year, when Paris fell by an average of -0.5% per month making Paris a strong buyer’s market.

Sales times: a crucial factor for the coming months.

Against this backdrop of falling prices, are sellers fully accepting buyers’ negotiations? The very high level of average selling times in France’s eleven largest cities suggests that this is not the case. In fact, they even show a certain wait-and-see attitude on the part of sellers who can afford to sit by. In fact, the average time to sell a property in these cities on March 1, 2024 was 77 days, compared with 59 a year ago, an increase of almost 18 days. In fact, the top ten metropolises recorded an average sale time of less than two months! Over the last quarter, Bordeaux and Toulouse saw their average sales times increase by 15 and 10 days respectively. Montpellier, with its 14-day increase over the quarter, currently holds the record for the longest sales time among the eleven largest cities. In France’s largest cities it takes an average of three months (90 days) to sell a property there, compared with two and a half months (76 days) a year ago. In Montpellier, sellers clearly do not seem to accept current market conditions, or at least take longer than traditionally to reach an agreement with buyers. Although prices in Montpellier have risen by +2% year-on-year, such delays in selling do not suggest a positive outlook for the city. Indeed, if the conditions that will enable buyers to regain their purchasing power are slow to return, some sellers will no longer be able to afford to wait and will be forced to lower their prices.

Towards a return of real estate purchasing power?

The wage increases implemented in certain organizations at the start of the year, in line with inflation, combined with a slight improvement in credit access conditions (down 0.25 percentage points between December 2023 and February 2024 – source Empruntis), are enabling French households to regain a few square meters of purchasing power.

On a national level, prices would have to fall by a further 17% to return to the initial level of real estate purchasing power enjoyed by French households prior to the rise in interest rates.

Source: https://backyard-static.meilleursagents.com

Contact Paris Property Group to learn more about buying or selling property in Paris.