Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

The residential real estate market in Paris compared with the rest of France

Paris is one of the world’s primary business centers and tourist destinations, and demand for residential property is high. Several factors have ensured that the Paris real estate market has remained buoyant over the past 25 years, despite periodic bear markets:

- There is a shortage of new construction.

- The city center cannot expand beyond the périphérique ring road.

- Real estate buyers favor properties in period buildings, for which demand outstrips supply.

This is the analysis of the Chambre des Notaires de Paris, the representative body of the officials who handle property transactions.

France has 33 million homes, 30% of them in the Paris/Ile-de-France region. The market varies between regions, but supply often fails to meet demand for high quality housing, particularly in urban areas – and especially in Paris.

Intense economic activity, a dense population and a shortage of new construction have combined to give historically high prices in and around Paris. There is a big gap between the price of apartments in the capital and in other French cities. Only in a few upscale tourist destinations, including the Côte d’Azur and the Alpine ski resorts, do prices rival those of Paris.

Real estate prices increased sharply in Paris during the 1980s but then fell during the mid-1990s. Prices in other parts of France had increased at a lower rate and the decline was less steep.

Buyers returned to the market at the end of the 1990s, aided by falls in interest rates and favorable tax measures. This generated a surge in demand, especially in Paris. Prices doubled throughout France between 2002 and 2007.

The 2008 financial crisis put the brake on market activity again. But government action and low interest rates resulted in activity bouncing back from 2009. According to the notaires, the annual price growth rate in Paris reached 20% at times, and prices exceeded their pre-crisis levels.

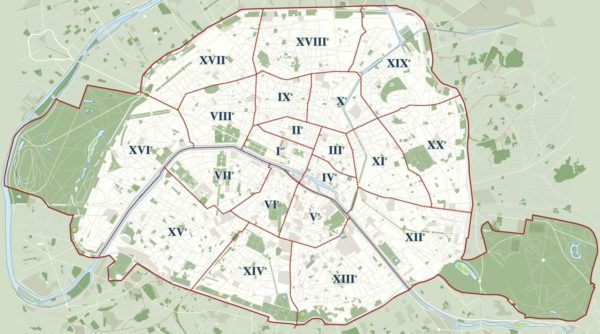

Today, property prices both within and among arrondissements (districts) in Paris remain varied, as does the rate of price increase. Recent notaires’ figures show that prices in the Rive Gauche 6th and 7th arrondissements have seen a correction from very high levels. But other central arrondissements, including the 1st, 3rd and 4th, saw increases of 5.7%, 0.2% and 2.8% respectively over the third quarter of 2014.

With interest rates at a historically low level and other types of investments more volatile, the notaires say that buyers continue to see real estate as a secure bet.

Contact Paris Property Group to learn more about buying or selling property in Paris.