Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

The UK lowers the threshold for stamp duty on property purchases through a company structure: how does this compare with France?

The UK government has cracked down on the practice of purchasing properties through a company structure in order to avoid paying stamp duty. This measure is aimed in particular at wealthy foreign buyers who have bought investment properties that have subsequently been left empty.

The UK Chancellor of the Exchequer (finance minister) George Osborne had already imposed a 15% stamp duty on “corporate envelopes”, or company structures, which bought property for more than £2 million. As of March 19th 2014, he lowered the threshold to £500,000. Osborne granted exemptions for properties that are rented out in an attempt to increase the stock of much-needed rentals properties in London.

Individuals buying residential property in the UK pay stamp duty at a rate of 1% on properties from £125,000 to £250,000 and at 3% on homes priced at up to £500,000. Rates continue to rise to a maximum of 7 per cent on homes over £2 million.

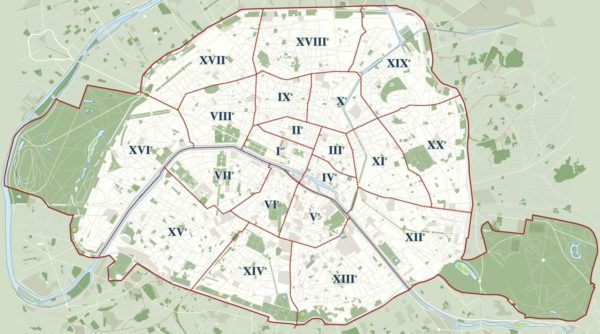

In France, individual buyers pay a flat rate of stamp duty. The rate of stamp duty is the same if real estate is sold via a transfer of shares in a Société Civile Immobilière (civil property company). In most French départements (counties), stamp duty increased for two years as of March 1st 2014 from 5.09% to 5.8% to finance benefits payments. However, the City of Paris decided not to apply this increase, so the rate remains at 5.09% of the purchase price.

UK commentators had hoped that Osborne would revise the thresholds for stamp duty at the lower end of the market but they remain unchanged. Some fear that the 15% stamp duty rate for corporate purchasers might deter foreign buyers and stall the mid-range UK residential property market.

You might also like:

Foreign exchange: the prospects for the euro against the dollar and the pound sterling in 2014

Now is the time to buy prestige property in Paris, say real estate pundits

French real estate compared to other investment vehicles

Stamp duty on property sales in Paris will not increase as of March 1st 2014

Expenses you can offset against French capital gains tax

Contact Paris Property Group to learn more about buying or selling property in Paris.