Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

Capital gains tax on property sales by non-residents: the UK follows France and the US

France may have led the way in imposing capital gains tax (CGT) on sales of second homes but the UK is now following suit.

We posted an update in November about the frequently-changing rules on CGT in France. Non-resident owners are liable for CGT and social charges on sales of secondary residences.

Now, the UK is jumping on the bandwagon. UK Chancellor of the Exchequer (finance minister) George Osborne announced the move in his recent pre-budget autumn statement. Currently, property owners who are non-resident in the UK for tax purposes are exempt from CGT. As of April 2015, they will have to pay CGT on real estate sales at the same rate as UK residents, who normally pay 28% of the profit realized from the sale of a second home.

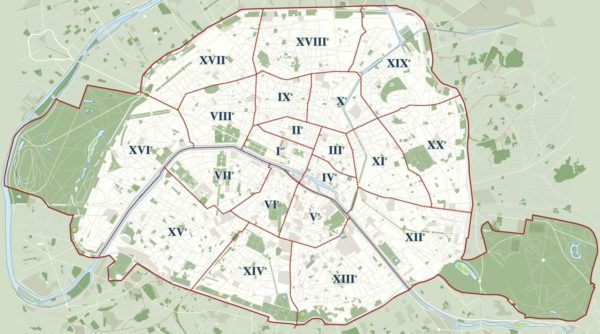

The decision brings London more closely into line with the other real estate investment hotspots, New York and Paris, where non-resident owners must pay tax on increases in property values when they sell. The UK government expects the new ruling to raise £70 million per year by 2018-19.

In addition to raising tax revenue, the changes are intended to cool the overheating real estate market, notably in London. The UK capital has long been a target for wealthy foreign investors and around 25% of central London property sales are to foreign buyers. London real estate prices have risen by 10% on average in the past 12 months – even more in some sought-after neighborhoods. This has raised fears of a London-led property bubble that would leave local people unable to afford a home.

However, some experts are skeptical about the likely effect on the British property market and are not expecting a mass sell-off by foreign owners before the new rules come into force in April 2015. They argue that international buyers seeking residential properties in major cities are driven by many factors and taxation is not a primary concern.

You might also like

Paris real estate sales during the 3rd quarter of 2013

French real estate compared to other investment vehicles

European real estate trends: foreign investors target Paris

Russian, Chinese and Middle Eastern buyers give the French prestige property market a boost

Contact Paris Property Group to learn more about buying or selling property in Paris.