Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

European real estate prices not inflated, Savills report concludes

Following an in-depth look at housing market behavior across Europe in recent years, the research arm of Savills Real Estate found that only Italy might be in for future drops in real estate prices.

The report revealed a direct relationship between the growth in housing prices prior to 2007/2008, and the extent of price falls subsequently in that market. By this measure, Italy looks as if it should be in for further falls, says Savills.

The research went on to reveal a surprisingly uniformity in average house prices across most of Western Europe. In the UK, the average is €205,330; in Germany, €236,000; in France, €216,000; in Ireland, €207,000; and in Italy, €264,000. Spain trails behind at €164,000. What’s more, the ratios of house prices to economic performance, measured by GDP per head of population, are remarkably consistent over the euro area, averaging just over five times GDP.

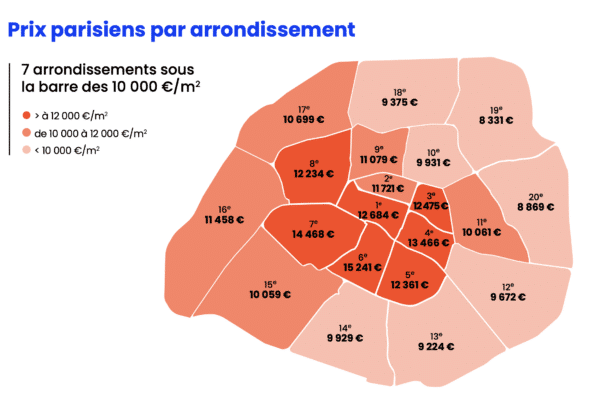

However, major urban markets like London and Paris behave more like each other than like other cities or regions within their own countries. In fact, prime urban markets across the globe have more in common with each other than with cities in their provinces.

‘As international markets adjust to the new realities of finance and affordability, it would seem that sub-regional geographies vary far more within nations than between nations. This means that average prices are becoming increasingly meaningless and conceal a huge range of different experiences,’ said Yolande Barnes, head of global residential.

That can mean a formidable challenge for governments as they try to design economic stimulus efforts in the near term. “All this local diversity means there never was a worse time to be looking at one size fits all policies to stimulate housing construction, private renting or regeneration” Barnes added.

The report also reveals that the UK is not alone in having a high percentage of owner occupied properties and low rental percentages. 20 years ago the UK stood out on those figures, especially in comparison to pre-unification Germany; but here too the playing field seems to have leveled across most of Western Europe. The UK had a current owner-occupied rate of 69%, comparable to France, Denmark and the Netherlands, and slightly lower than the 72% average in the eurozone. Germany still lags at 56%, but closing ground.

In its final analysis, Savills dismisses the relevance of those figures, suggesting that the health of a housing market has more to do with the extent of over-borrowing and price over-heating than it does with the absolute level of owner occupation. “There is nothing to suggest that home ownership levels per se make a housing market more volatile,” said Barnes.

Contact Paris Property Group to learn more about buying or selling property in Paris.