Stability and favorable economic factors keep Paris in an elite group of world-class cities with vibrant and secure real estate markets that offer both investment growth and enjoyment over the long term.

How does Paris compare to other major European capitals in terms of real estate investment potential? What evolving rental market dynamics are impacting property values within city limits? How are major infrastructure developments shaping intramuros property values and fueling the rise of emerging neighborhoods? And perhaps most importantly, how does Paris consistently remain a resilient and attractive option for real estate investors?

Answering these questions is key to navigating the Parisian real estate landscape confidently and capitalizing on its enduring strength as a strategic long-term investment. Let’s dive in.

A Bumpy Path to the Summer 2024

The Parisian real estate market has experienced some wild fluctuations over the past four years, reaching a historical price peak in 2020: an average of €10,860 per square meter. This was fueled in large part by a combination of low interest rates and the global real estate buying frenzy that took place in the early months of the COVID-19 pandemic.

As COVID dragged on, and the European Central Bank (ECB) maintained low interest rates to stimulate stagnant EU economies, mortgage rates hit an all-time low of 0.75% for French resident buyers (whereas, rates are 25-50 basis points higher for non-resident buyers). The end result:

a 20% y/y rise in real estate transaction volume in Paris by Q1 2022.

In the face of mounting inflation, the ECB tightened its belt and raised its rates, which sent mortgages above 4% in the span of only 18 months. Real estate transaction volume slowed dramatically, with 25% fewer sales in Paris in 2023 (versus 2022). Sales decreased in similar proportion between 2023 and 2024.

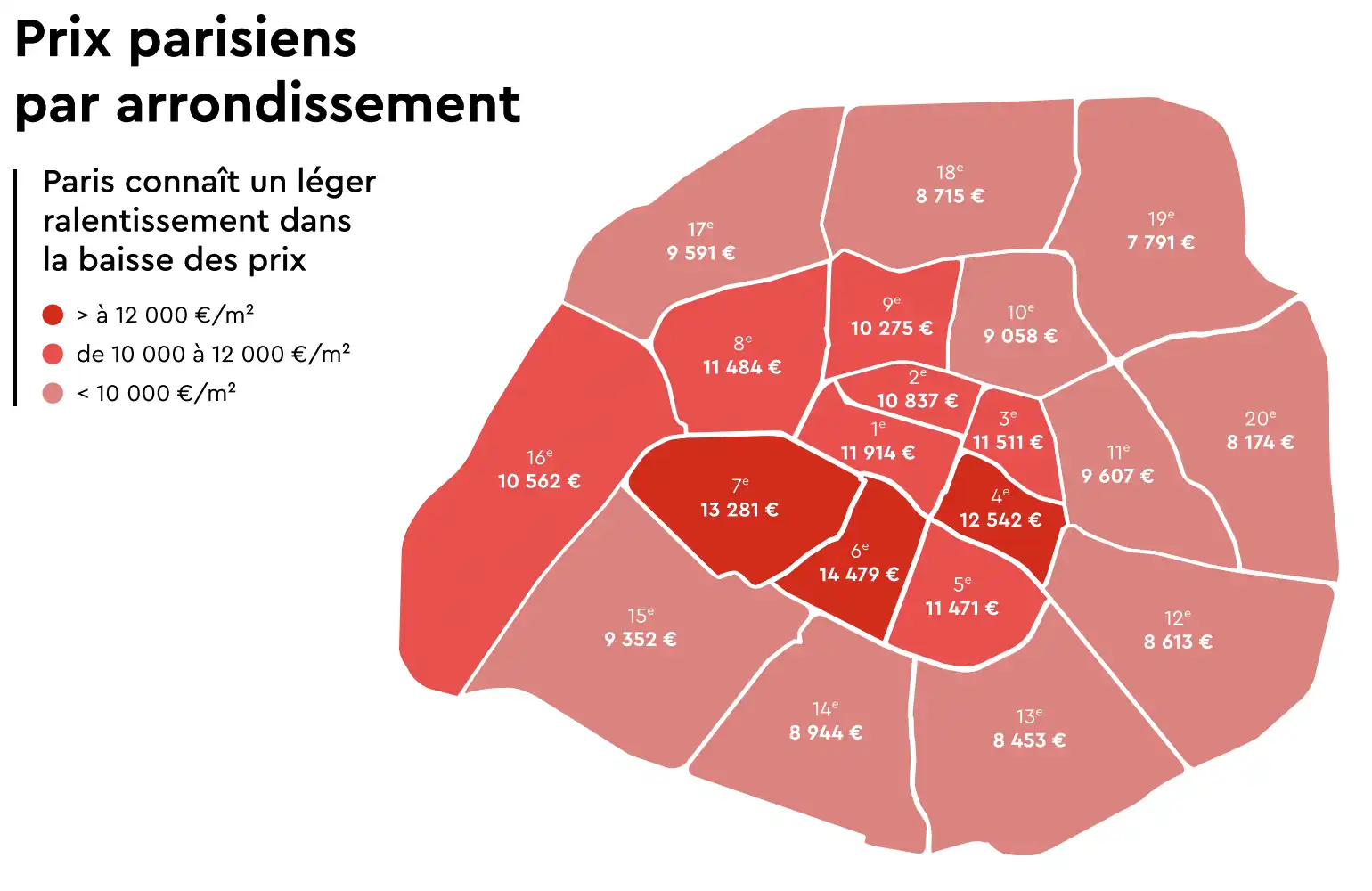

Today, the average price per square meter in Paris is €9,838—a decrease of 10% from its 2020 peak. Resident mortgage interest rates hover around 3.5%, and prices across the Parisian real estate market are beginning to stabilize. As a point of reference, here’s a look at how Paris real estate stacked up to other major European markets in 2023:

- London: €14,000/m²

- Munich: €10,500/m²

- Amsterdam: €7,600/m²

- Berlin: €5,200/m²

More affordable borrowing conditions, coupled with a projected 2.5% controlled inflation over the next year, should give transaction volume a boost and send prices climbing once again, especially in the afterglow of the 2024 Paris Olympics.

>> Spotlight on European Rental Market Dynamics

According to the latest DoorFeed July 2024 real estate data, the Parisian rental market remains strong, with an average rental yield of 3.61% (furnished) and 3.24% (unfurnished), respectively, while PMA data points to the vacancy rate dipping to 2.8% in 2023.

This is mostly on par with the average gross rental yield seen in other major European hubs:

- London: 3.4%

- Munich: 3.26%

- Amsterdam: 5.23%

- Berlin: 3.83%

Paris’s mix of international appeal, cultural significance, and perennial status as a global business and economic hub drive continued demand. This is especially true in the central and most desirable parts of the city, which have rebounded following a years-long crackdown on illegal short-term (or Airbnb-style) rentals—that had both diminished the city’s long-term residential rental supply and significantly inflated rental prices.

Strategic Investment Areas and Infrastructural Developments

1. Grand Paris Express and Metro Line 14 Extension

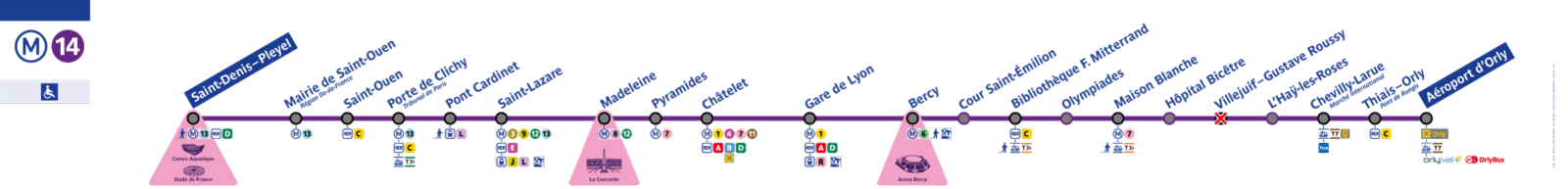

Major projects like the Grand Paris Express and the Metro Line 14 extension are set to transform the city’s accessibility and connectivity.

The Grand Paris Express, a €35 billion investment, will add 200 kilometers of new metro lines and 68 new stations—significantly enhancing the city’s public transportation network.

Additionally, as of June, Metro Line 14 began running all the way to Orly—a smaller but growing alternative to Paris’s Charles de Gaulle airport—and was completed just in time for the kick-off of the 2024 Paris Olympics. This extension improves access to and from the city, which will have a positive effect on property values in Paris’s historically overlooked southern neighborhoods.

2. Emerging Neighborhoods

The area around Station F

, the world’s largest startup campus established in 2017 in Paris’s 13th arrondissement, is a great example of urban transformation in action. This formerly nondescript, industrial pocket of the city is now a vibrant and bustling area that has become synonymous with global tech brands and top-notch talent. The development has already reinvigorated the surrounding neighborhood and increased property demand significantly.

Look for a similar bump in property value in the Seine-Saint-Denis area once the Olympic Village is converted into residential housing following the close of the Olympic Games. This project is expected to drive business growth and property values in a traditionally underserved area.

3. Energy Renovation and Eco-friendly Initiatives

In 2006, France established a law requiring real estate sellers to publish an energy efficiency grade (A-G rating)—known as an Energy Performance Certificate (EPC)—in the disclosures that accompany the sale. Since then, additional regulatory requirements and increased consumer preferences for sustainable living have continued to drive demand for more energy-efficient homes throughout France.

Within the densely-built walls of Paris, however, new-build is a rarity, and most Paris buildings have failing energy grades. For that reason, the focus in the capital is to shore up the energy rating in older buildings with double-pane windows or improved insulation.

These upgrades are not entirely voluntary. Starting in January 2025, properties with a “G” rating will be excluded from the long-term rental market until they are in compliance. That limitation will extend to F-rated properties in January 2028. Paris landlords, therefore, have a lot of work to do in the coming months to meet those deadlines.

Although the city offers very few financial incentives or tax breaks to encourage such renovations, Paris has made clear its commitment to eco-friendly developments like new green spaces and expanded pedestrian- and bike-only areas. This is part of a bigger and bolder program to enhance the city’s air quality, attractiveness, and livability.

One important part of this plan, for example, is the Champs-Élysées “Garden Project.” This major urban development project will transform the world’s most famous avenue—including its endpoints at Place Charles de Gaulle-Etoile et Place de la Concorde as well as the famed Avenue Montaigne and Avenue de la Grande Armée—by adding 15,000 m² of new green space and pedestrian- and bike-friendly zones. This will undoubtedly have a direct impact on property values in the surrounding 8th,16th, and 17th arrondissements.

Two Tips for Thriving in the Parisian Real Estate Market

1. Think long-term:

On average, aim for a minimum 5-year investment horizon to realize value in the Parisian real estate market. Average prices in the French capital are down 12.2% from two years ago, but up 13.8% from 10 years ago.

Buying property in France involves significant closing costs, called “notaire fees,” which range between 6.5% to 7.5% of the purchase price. These significant upfront costs make flipping property unattractive for private investors, while developers are incentivized with smaller taxes on their promise to resell. Still, incredibly low annual property taxes—roughly, .2-.3% of the purchase price, a 50+% increase since last year—and low monthly building fees help offset these initial expenses over time.

2. Look beyond the center: Location is the most important factor when investing in real estate anywhere. In Paris, the highest demand—and the highest prices—remain in the city’s center. Purchasing in this area is considered a “safe” investment bet, although the returns are not as high. As an alternative, consider investing in emerging neighborhoods where property values are likely to grow significantly in the coming years.

Conclusion: “Paris is Always a Good Idea”

Audrey Hepburn’s famous words ring as true about the real estate market as they do about the city itself. After all, in perennially popular single-digit arrondissements, like the Marais (4e) and Saint-Germain-des-Prés (6e), demand is as robust as ever for historic properties that seamlessly blend old-world charm with modern amenities.

Even so, Paris is rapidly changing in response to challenges with housing supply, population growth, air quality, social and medical services, and more. Additionally, major infrastructure investments and urban transformation projects are shining a spotlight on lesser-known neighborhoods, giving early adopters the opportunity to make strategic high-growth investments before everyone else catches on.

For these reasons, Paris continues to be a “good idea” for real estate investment.

Contact Paris Property Group to learn more about buying or selling property in Paris or to be introduced to a trusted mortgage professional.

Sources

- Meilleurs Agents (2024). Prix immobilier à Paris (75000).

https://www.meilleursagents.com/prix-immobilier/paris-75000/ - Meilleurs Agents (2024). Focus sur le marché immobilier parisien.

https://edito.meilleursagents.com/actualites/conjoncture-immobiliere/focus-marche-immobilier-parisien-article-18703.html - Meilleurs Agents (2024). Baromètre immobilier : on fait le bilan de ce premier semestre 2024.

https://edito.meilleursagents.com/actualites/barometre-meilleurs-agents/barometre-immobilier-bilan-de-premier-semestre-2024-article - Meilleurs Agents (2024). Baromètre national des prix de l’immobilier (Juin 2024).

https://backyard-static.meilleursagents.com/press/f6f5716c4034b81b46554a1c118ea3a93bdfce23.pdf - Banque de France (2024). Statistiques.

https://www.banque-france.fr/fr/publications-et-statistiques/statistiques - Le Partenaire (2024). Observatoire Marché Immobilier Paris (75000).

https://www.le-partenaire.fr/immobilier/observatoire-marche-immobilier/ile-de-france/paris/paris/75000 - Doorfeed (2024). Residential real estate market data in Paris.

https://www.doorfeed.com/insights/france/paris - Real IS (2024). Markets in Focus: Strong Growth Drivers for the Paris Real Estate Market.

https://www.realisag.de/fileadmin/mediapool/research/news/2024/03/Research_News_03_2024_ENG.pdf - Global Property Guide (2024). Gross rental yields in France: Paris and 7 other cities

https://www.globalpropertyguide.com/europe/france/rental-yields - Global Property Guide (2024). France’s Residential Property Market Analysis 2024.

https://www.globalpropertyguide.com/europe/france/price-history - Global Property Guide (2024). Gross rental yields in Germany: Berlin and 7 other cities.

https://www.globalpropertyguide.com/europe/germany/rental-yields - Global Property Guide (2024). Gross rental yields in Netherlands: Amsterdam and 2 other cities.

https://www.globalpropertyguide.com/europe/netherlands/rental-yields - Paris Unlocked (2023). Champs-Elysées “Garden” Project Approved Amid Wider Greening Plans for Paris.

https://www.parisunlocked.com/news/champs-elysees-garden-transformation-green-plans-paris/ - FlatMates.uk (2024). London’s Rental Yield Hotspots: Where to Invest in 2024.

https://flatmates.uk/blog/londons-rental-yield-hotspots-where-to-invest-in-2024

Social Cookies

Social Cookies are used to enable you to share pages and content you find interesting throughout the website through third-party social networking or other websites (including, potentially for advertising purposes related to social networking).