Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

Is Paris real estate now a buyer’s market?

Winter Chill Descends on French Real Estate Market as Top Cities Grapple with Ongoing Price Decline.

Paris Sees Unprecedented Monthly Drop; Ile-de-France Region Follows Suit.

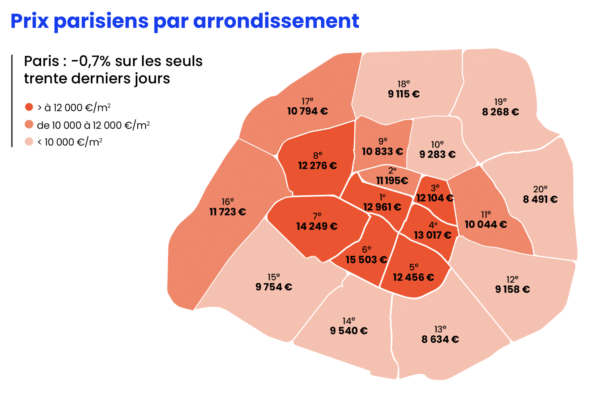

The price decline that commenced several months ago persists in the French real estate market, casting a shadow over the prospect of improvement. Recent data indicates a year-on-year decrease of 0.7% across France, with the Top 10 cities experiencing a more pronounced decline at -1.9%. Only rural areas have managed to defy this trend, clinging to a modest 2.2% increase over the past year. Yet, the vigour that characterized this market segment since the onset of the COVID-19 pandemic is showing signs of waning, in stark contrast to the robust growth of 10.7% in 2021 and 7.1% in 2022.

The adjustment of prices to these new market conditions appears to be accelerating, particularly in municipalities like Paris, which witnessed a 0.7% drop in October alone, translating to a 5.4% decline over the year. This downturn mirrors the tumultuous period of 2009 when the real estate crisis shook the French market. Paris is not alone in grappling with this downturn; Nantes also experienced a challenging October with a decline of 0.8%. The trend extends to eight of France’s eleven largest municipalities, signaling a broadening impact and an inevitable adaptation to rising interest rates.

The ripple effect is evident as Ile-de-France, once insulated from Paris’s troubles, now succumbs to the capital’s downward momentum. Over the last twelve months, the entire region has posted negative results. In the inner suburbs, the most expensive areas have borne the brunt, with Hauts-de-Seine experiencing a 4.7% decline, Val-de-Marne -3.4%, and Seine-Saint-Denis -2.6%. Even within these suburbs, the towns with the highest prices, such as Charenton-le-Pont and Vincennes, are particularly affected.

Contrary to expectations, the outer suburbs tell a different story, with Yvelines and Val d’Oise experiencing less pronounced declines compared to their inner counterparts. Surprisingly, Essonne, the most affordable department, witnessed the most significant contraction in prices at 5.5%. Seine-et-Marne, though affected, appears to have weathered the storm better with only a 0.5% decline over the year.

Individual house prices have borne the brunt of the falling market, contracting at twice the rate of apartment prices, with a 0.8% decrease since January. Larger surface areas and higher purchase values have made houses more susceptible to the impact of rising lending rates. This has led to a nationwide trend where two-thirds of the regions have seen a fall in house prices compared to only a third experiencing a decline in apartment prices since the start of 2023.

The geographical disparity is notable, with the largest metropolitan areas such as Rhône, Gironde, and Loire-Atlantique facing the most significant drops in apartment prices, while the Grand East and Centre-Val-de-Loire regions bear the brunt of house price declines. However, regions with a high proportion of second homes, especially along the coast or in the mountains, continue to experience rising prices, attributing their resilience to being less credit-driven markets.

As winter takes hold, the French real estate market faces a challenging landscape, with uncertainties about the duration of the downturn and the potential for a seasonal rebound in the spring. The convergence of these factors paints a complex picture for both buyers and sellers navigating the evolving market conditions.

Source: MeilleursAgents.com

Contact Paris Property Group to learn more about buying or selling property in Paris.