Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

Paris, New York, and London: A comparison of real estate prices and market conditions

The erosion of prices, which has existed for several years in Paris, now seems to be spreading to London. On the other hand, prices are still rising and historically very high in New York. But for how long?

It is interesting to note that in England, the United States and France, as in many OECD countries, residential property prices have risen very rapidly in recent years. The same causes producing the same effects – after the health crisis, the real estate markets were boosted by easy access to credit, low interest rates, abundant savings, built up in the absence of being able to consume, and the massive development of teleworking.

The recent deterioration in the overall environment, heightened economic uncertainties (weakening growth with high inflation), tightening monetary policies, and high geopolitical tensions have begun to weigh on real estate activity and sales in recent months, often, but not always, dampening price increases.

In the United States, price increases have been particularly rapid in recent years. From June 2020 to June 2022, prices for all homes combined rose by 39% in the United States and by 35% in New York (according to Case Shiller). During 2022, the construction of homes and the supply of homes for sale remained very low and prices were therefore resilient, despite the decline in sales volumes throughout the year. An initial slowdown was nevertheless perceptible at the end of 2022 with the first decline in prices in both the United States overall (-2.7%) and in New York city (-1.5%) between June and September 2022.

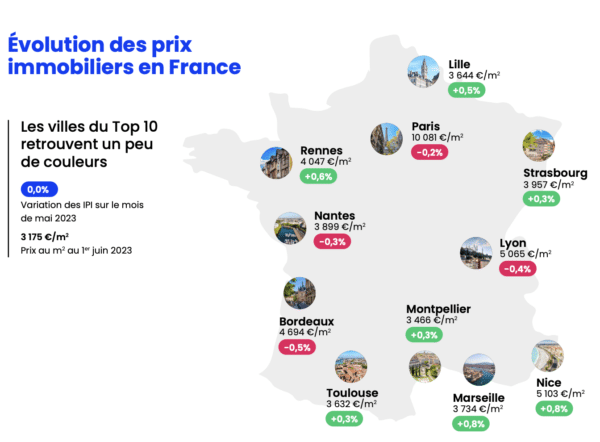

In Paris, prices have eroded slightly over the past three years. Cumulatively, prices have fallen by 2.5% from the November 2020 high point to November 2022. But the annual decline in prices has remained fairly constant (-1.7% from November 2020 to November 2021 and -0.8% from November 2021 to November 2022). At the same time, price increases for older, existing homes have been much faster across France (+9.6% from Q3 2020 to Q3 2022).

In England, the introduction of property tax exemptions due at the time of purchase, from July 2020 to September 2021, designed to facilitate home ownership, have also increased pressure on demand and pushed up prices (+16% in Q2 2020). +8% in London according to the Office for National Statistics). Then the trend turned downward, no doubt in line with the economic situation. In London, as in Paris, price trends have been more moderate in recent years (-1% in London from

Q2 2021 to Q2 2022, the latest known figure, but -10% in England over the same period).

Prices remain very heterogeneous in these international metropolises

It is difficult to compare Paris with other major international cities due to its specific characteristics: a very limited geographical area and particularly high population density (2.1 million inhabitants on 105 km², i.e. more than 20,000 inhabitants/km² living in old and small housing stock). London, whose housing stock includes more houses and large surfaces, is 4 times more populated than Paris but 15 times larger (8.9 million inhabitants on 1572 km²). It is therefore 4 times less dense. New York has a population similar to London but on a smaller area (9 million inhabitants on 785 km²) and therefore has an intermediate density. In spite of these differences, the comparison between the three cities is rich in information.

Today, the price of a home can be estimated at €593,000* in Paris compared to €600,000 in London and €740,000 in New York. But these prices, which are actually quite similar, cover different realities.

In the three metropolises, there is still a strong dispersion between the values of the different neighborhoods, including in Paris, despite a concentration on a much smaller area. It is also worth noting that these differences are increasing in the three cities.

In the French capital in 2022, the average price of a home in the Invalides neighborhood (7th) will reach €2,700,000 compared to €340,000 in La Chapelle (18th), the most affordable of the 80 neighborhoods. This ratio of 1 to 8 is more moderate than in the other two metropolitan areas where it is 1 to 15, which is logical given their scale. A slightly larger scale (from 1 to 10) is found throughout the Ile-de-France region, since the average sale price of housing in some municipalities is close to €100,000, while it exceeds €1,000,000 in other municipalities in the region.

In London, €247,000 (median annual price at the end of June 2022) is needed to buy a home in Abbey, the least expensive of the 640 wards in the Barking and Dagenham district, while it costs almost €4,000,000, i.e. fifteen times more, in the very posh Knightsbridge and Belgravia district of Westminster.

In New York City (typical monthly price at the end of November 2022), among the 202 neighborhoods in the city, the extremes range from €200,000 in Parkchester (in the Bronx) to €3,280,000 in Tribeca (near the One World Trade Center).

* Sales price in Paris = price per square meter based on indexes x average surface area

Source: Notaires de Paris

Contact Paris Property Group to learn more about buying or selling property in Paris.