Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

2023: A struggling real estate market in France

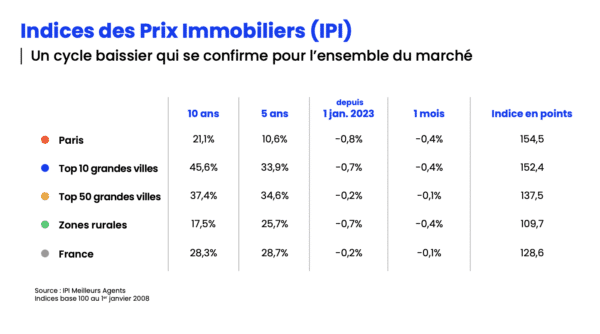

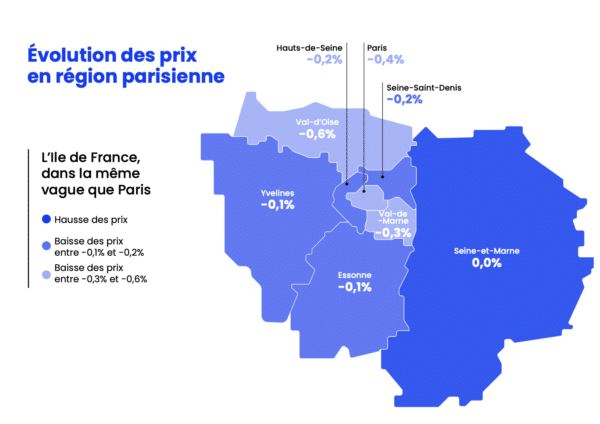

The year 2023 is off to a slow start for the French real estate market. Since the beginning of January, prices at the national level have fallen by -0.2%. Since the end of 2022, all areas of the real estate market have gone into the red, a phenomenon we have not seen since 2014. While the capital remains unsurprisingly on a downward trend (-0.4% over the past month), this is now the case for all the French municipalities in the Top 10 (-0.4%) as well as those in the Top 50 (-0.1%). The rural areas which, since the Covid pandemic moved the market forward, continue to see their prices falling as well (-0,4%). Usually, February marks the end of the winter break in terms of price changes. In other words, after the traditional lull in November, December and January, prices usually begin to rise each month during the spring surge.

Average price per m²

France 3,198 €/m2 (-0,1%)

Paris 10,154 €/m2 (-0,4%)

Winter 2023, harsher and longer than expected

Already weakened by the health crisis, France’s main cities seem to have gone into negative territory. While Nice is still the exception, with rates up +0.7% in one month, no other city has escaped this downward trend. Marseille, itself, which until then had been pulling the market upwards and experiencing spectacular growth (+11.2% in one year), recorded a -0.4% drop in prices in February of this year. The strongest drops returned to Lyon and Nantes which, both, saw their prices fall -1% during February and more than -2% since the beginning of the year (-2,4% in the prefecture of the Rhône and -2,2% in that of Loire-Atlantique).

The drop in loan production will weigh on sales volumes

While the magnitude of the decline in real estate prices remains modest for now, the drop in loan production is more worrisome for sales volumes. According to figures from the Banque de France, the production of real estate loans has indeed been falling rapidly for the past six months. Last December, French banks granted 30% fewer loans compared to December 2021. While the usury rate argument has been put forward, its calculation methods at least until next July, should not change the situation. Certainly, this decision appears to be good news for certain files that were blocked by this borrower protection mechanism, but the rapid rise in rates that should accompany it will not fail to have consequences on the solvency of many would-be buyers who, in fact, will find themselves mechanically excluded from credit.

Moreover, this will not change the current reluctance of banks to lend. This is not only due to the new monetary policy of the European Central Bank, but also to the current economic environment (notably higher than expected inflation). This is illustrated, once again, by the situation in Belgium and Germany, where, despite the absence of the usury rate system, loan production has also been drastically revised downwards (respectively -36% and -43% of monthly production between December 2021 and December 2022).

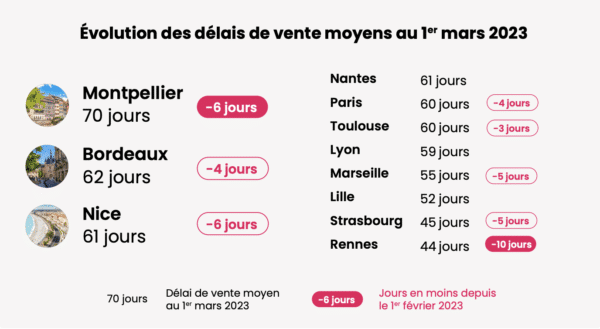

Sales delays

The only ray of sunshine in this context is that sales times are getting shorter in the main French cities. Since November, it has taken an average of one week less to complete a transaction, with four days gained in February alone. This faster decision-making by buyers is a positive sign for the market in the weeks to come because it contradicts the idea that the market has entered a stagnation phase despite the current economic situation. On the contrary, it shows that there is still a willingness to buy and that some sellers are willing to adjust their prices downwards without delay. In this respect, the shortening of the sales deadlines hits at a real estate spring that is certainly later and perhaps more timid than in previous years.

This means that the resurgence of interest in real estate is likely to be more pronounced than in previous years. In other words, the upturn in activity traditionally observed during this time of year should once again occur. Despite a global context of decreasing prices and volumes, some project owners should indeed make their dream of buying a home come true, as is always the case when the weather moves into spring sunshine. Especially since this seasonal phenomenon could be accompanied by a more general awareness on the part of sellers of the new bearish face of the market. It remains to be seen whether this will be enough to allow the market to maintain this momentum once spring is over.

Contact Paris Property Group to learn more about buying or selling property in Paris.