Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

France real estate purchasing power over the past 60 years

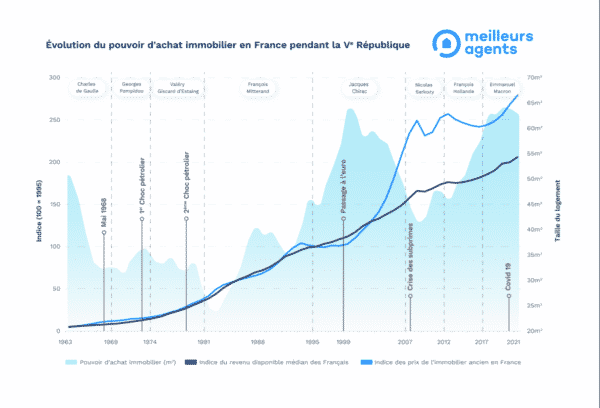

As the presidential elections quickly approach, with a first round in less than 6 months, Meilleur Agents, leader in online real estate valuation, analyzes the evolution of the real estate purchasing power of the French property market under the Fifth Republic (1958 to present). Oil shocks, changeover to the Euro, subprime crisis, Covid19 … Which crises have really impacted the real estate sector? What is the real estate purchasing power of the French property market in 2021 compared to that of the 1960s?

For 5 years the real estate purchasing power of the French property market has been at its highest in the history of the Fifth Republic!

In 2021 French real estate buyers can buy more for their money than they could 50 years ago!

Contrary to popular belief and despite the rise in real estate prices: 50 years ago, it was not better. Indeed, and this is unprecedented under the Fifth Republic, the real estate purchasing power of the French property market has remained (since 2017) at levels above 60 m2 for a median disposable household income equivalent to 2,525€ today.

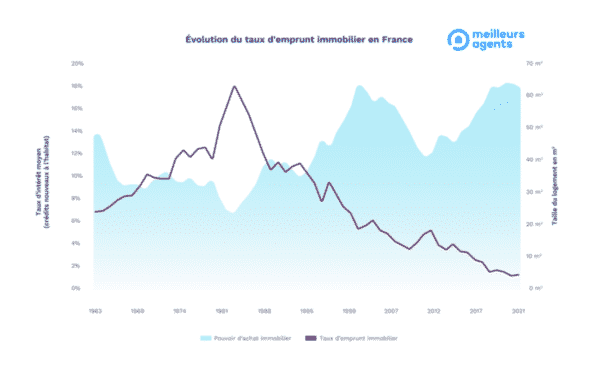

“For 5 years the real estate purchasing power of the French has stabilized at its highest level in the history of the Fifth Republic, only previously reached in 1999 for a short period of one year. This situation is explained by an environment of mortgage rates at historically low levels in recent years (<2% since 2017). This was enough to neutralize the price increase (+ 14.5%) greater than that of income (+ 11.2%) during the period, ” says Barbara Castillo Rico, Head of Economic Studies at Meilleurs Agents.

The subprime crisis marks a record drop in the number of real estate transactions

In 2008, Europe was hit by the financial crisis initiated in the United States resulting from generalized real estate financing to less solvent households: it was the subprime crisis. This will slow down the sharp increase in the property price index in France, which lost -7.2% in 1 year with a particularly low annual transaction volume approaching 500,000 transactions in 2009 (in comparison, more than 1.2 million reached in 2021.)

The 90s: real estate euphoria, the French gained 23 m2!

The 1990s were marked by a new situation: income increased more strongly than prices, which remained stable (16% vs 1%), and borrowing rates continued to decrease (9.3% in 1993 until 5.2% in 1999). Households gained no less than 23 m2, and reached 64 m2 of real estate purchasing power. A situation that didn’t last, however, in the face of the real estate boom in the 2000s.

Long live the 80s … But not for real estate!

1982 reached a gloomy record low for the purchasing power of French households, it was the lowest level in the Fifth Republic (only 24 m2!), While the nominal interest rate broke its highest historical record, at 18% (as a result of the 2 oil shocks and the resulting high inflation).

At the same time, during the second part of the 80s, prices increased by 60% in 8 years.

Exclusive Study by Meilleurs Agents, Press release – November 2021

Contact Paris Property Group to learn more about buying or selling property in Paris.