Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

Nearly one million sales in 2019: the future of French real estate is looking bright

One million transactions are expected to take place this year. Prices, which continue to soar in Paris, differ greatly from one region to another, while particularly low rates encourage property investment.

With interest rates getting lower and lower and prices on a steady incline, the stars are still aligned for the French real estate market, according to a study published earlier this month by Century 21, which also suggests “that we will reach one million transactions in 2019,” says Laurent Vimont, President of the network. In 2018, the same record had also been broken, with 965,000 real estate transactions carried out, according to the FNAIM (Fédération nationale de l’immobilier). Here is a look back at the main takeaway points from the study.

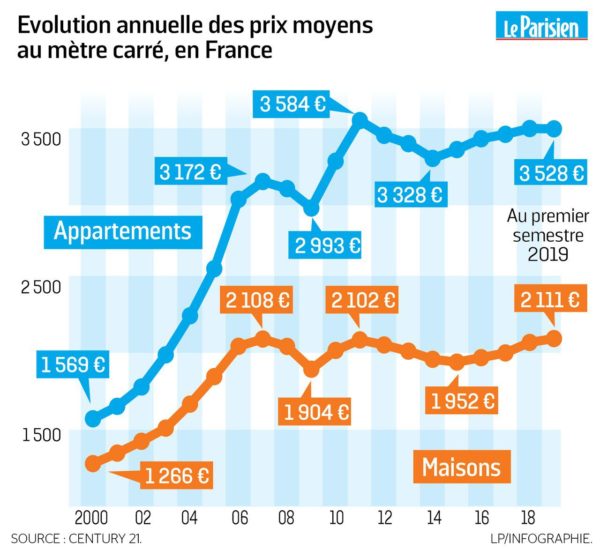

A market with a strong focus. Sales numbers have continued to increase. In the first half of 2019, volumes increased by 10.5%, driven by increasingly low interest rates. “The transition from ‘I want’ to ‘I can’ has never been so easy,” says Vimont. Average prices are around €2,599 per square meter (€2,111 for a house and €3,528 for an apartment), a moderate increase of 0.4% over a year. And this momentum seems endless: in May, the network’s 880 branches recorded a further 27% increase in requests for new real estate projects. The average selling price of a house is around €235,000 (for nearly 115 m2), while the average selling price of an apartment is around €205,000 (for 58,3 m2). The average selling time, on the other hand, remains stable at 92 days.

Annual Changes in Average Price per Square Meter in France

The credit market is at full capacity. The share of a real estate acquisitions financed by credit continues to increase, to almost 80%. Loan durations have increased from 20.4 years to 21.1 years in the span of 12 months. In some departments such as Hauts-de-Seine, the proportion of properties financed on credit even reached 97.4%, compared to 86% a year earlier.

Blue collar buyers and young people are benefiting from the upturn. The share of acquisitions made by blue collar individuals now stands at 41%, up 2.5% year-on-year, while white collar professionals are at 15%. “With a net income of €2,100 per month, you can now borrow €150,000 over 20 years without dipping into personal savings and have a mortgage of €700 per month,” Laurent Vimont calculates. Another demographic benefitting from the current market: young people. While 30-40 year olds represent 28.7% of sales, those under 30 now represent 20% – a 5% jump in one year.

Paris on its way to €10,000 per m2. The average price per square meter in the capital now stands at €9,937, up 7.2% year-on-year, while the average price of a 48.2 m2 property is almost €467,000 – more than twice the national average. While debt financing is only 66.6%, the average credit term has increased over the past twelve months from 20.3 to 21.2 years. Not surprisingly, white collar workers make up 49% of these buyers. Blue collar workers, who represented 10% of buyers in the capital in 2010, now only make up 4.9%.

Ile-de-France, a land of contrasts… Buying a house in Ile-de-France will now cost you €337,550 (or €3,051 per m2), while buying an apartment will require €227,500 (or €3,887 per m2). However, differences are very significant from one department to another. At one extreme, the Hauts-de-Seine region has become the second most expensive department in France after Paris: the average price of an property there is €680,860, with the average price per square meter now at €6,168/m2 for an apartment and €6,371/m2 for a house.

Apartment and House prices per Region in the First Semester of 2019

At the other extreme, in the large department of Seine-et-Marne, the average price of a home is €254,800, or €2,250 per m2, and €162,900 for an apartment, or €2,776 per m2. Prices in this department have fallen by 6.2% in one year.

… just like France as a whole. While the market is dynamic everywhere, some regions are doing much better than others. This is the case in Auvergne Rhône-Alpes, Grand-Est, Nouvelle Aquitaine, Pays de la Loire, and Paca, where buying a house costs nearly €424,000. On the other hand, prices in Bourgogne-Franche Comté, Bretagne, Centre-Val-de-Loire, and Normandie are on a downward trend. The prize for the most affordable region goes to Hauts-de-France, where you can buy a house for €141,600, and an apartment for €115,800 (prices per square meter of €1,339 and €1,806 respectively).

No clouds in sight. For the time being, no imminent threats are expected to end these sunny days. In particular, a sharp rise in interest rates is not expected. The only thing that could weaken this momentum would be a government decision that would impact rent, capital gains on property, or rental investment. “But let’s not give the government any ideas,” concludes Vimont.

Source: Bientôt un million de transactions en 2019 : grand soleil sur l’immobilier ancien

Cover photo: pxhere

Contact Paris Property Group to learn more about buying or selling property in Paris.