Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

The French choose property as their preferred investment

A recent survey found that a majority in France choose property as an investment, ahead of stocks and other assets.

Opinionway, a French polling organisation, asked people in France what investment options they were most likely to choose, yielding results that confirmed the number one position property has achieved in recent years. As France’s property market has recovered in 2016 and 2017, the asset has become the go-to investment target.

When polled, 34% of respondents said they would choose investing in property directly, putting it on par with a life-insurance mutual fund, the classic investment in France which was also chosen by 34% of respondents. But adding on the Plan Epargne Logement and an SCPI, funds that invest in property, results in 60% choosing property over other options.

Only 13% of people prefer stocks, while 18% choose the Livret A, the financial product offered by the French government to citizens. The latter, something which dates back to 1818, has seen its rate of return plummet in recent years which partly explains the rise in popularity of property.

Property and real estate are seen as stable long-term investment strategies with good returns. Only 22% mean capital gains when they cite ‘good returns’, with most opting for buy-to-let investments. Low barriers to access thanks to falling or zero-interest rates – and even loans with no deposit – mean for many it is a more practical option than trading stocks.

It’s not all rosy, of course. The most common downsides of property investment cited in the survey are the fees incurred (18% to 24%), excessive taxes (30%) and tenants that don’t pay up (46%). There are strong protective measures for tenants faced with eviction in France, which increases the perceived risk of buy-to-let property investment. Expert local real estate advice can make the difference between a good investment and a great one.

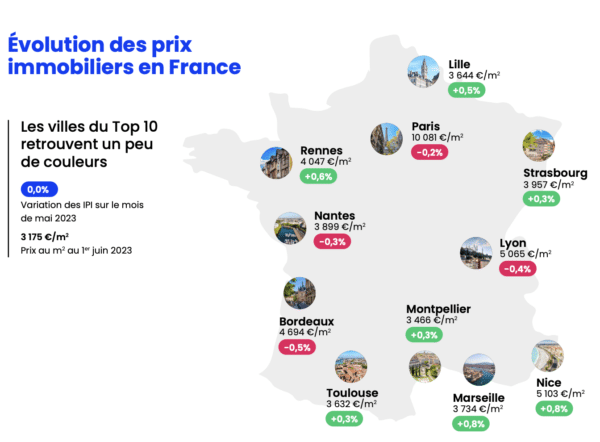

The survey also deciphered where people prefer to invest in the country. Almost half (44%) hope to invest in the capital region: 20% within the peripherique and 24% in the wider Ile-de-France suburbs. A small number of Parisians choose to invest outside their home region (17%).

Another survey earlier this year asked the same questions to 16 other countries, showing how France differs to other countries: the United State, United Kingdom, Spain, Italy, Germany, Switzerland, Belgium, Sweden, Hong Kong, Singapore, Japan, Taiwan, China, Brazil, Mexico and Australia were the other surveyed countries.

While fewer people in France are considering investing, relative to other countries – 25% versus the 45% average figure among all polled countries – more choose property when doing so. Some 26% of investors have, or hope to have, their funds in property of some sort, compared with 13% globally and 15% in Europe.

Paris Property Group is a full service real estate firm that specializes in international clientele looking to buy and sell residential or commercial property in Paris France. Learn more about our services for BUYERS or SELLERS, or CONTACT US with your inquiry.

Contact Paris Property Group to learn more about buying or selling property in Paris.