Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

What’s ahead for the Paris real estate market in 2017?

2016 has been a remarkably healthy and stable year for the French real estate market. With mortgage rates at all-time low and historically good currency exchange rates encouraging foreign buyers, new buyers and investors have boosted the market and continued the steady growth cycle that began in 2015. For 2017, though world and domestic politics present uncertainties, the new year seems promising.

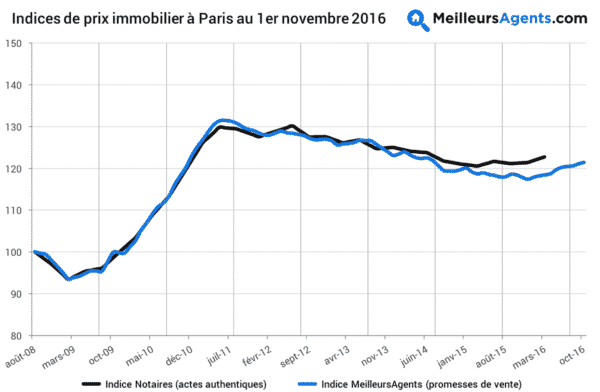

Prices, which dropped 7% between 2011 and 2015, are up 5% this year in Paris and expected to increase steadily. French mortgage rates are at an all-time low, and buyers in France are borrowing and investing in real estate. 90 % of buyers need loans to purchase their primary residence, and banks are giving very attractive interest rates, topping out at only a quarter of what they were in the early 2000s.

Paris Property Group’s frequent mortgage partner, International Private Finance has seen a 250% increase in inquiries from cash buyers looking to take advantage of the record low mortgage rates to borrow in Euros. These attractive conditions for purchasing property have been the main factor in boosting the real estate market and in recent years have reignited potential buyers’ appetite for purchasing property, after a long period of wait-and-see.

Bigger picture

Domestically, 2016 has been more stable than 2015. A lessening of fears surrounding national security after a torrid 2015 has helped. More than a year has now elapsed since Hollande’s government cancelled the 75% tax on earnings over one million euros, a measure which did nothing to help a stagnant economy and damaged France’s prestige worldwide. And so investors and capital are returning.

Foreign investment is up in both commercial and residential real estate, especially the luxury sector. The simultaneous uptake in domestic investment is reflected in an INSEE consumer confidence index, which measured 97 in October, up from 80 in 2013. This is the highest it has been since before the 2008 financial crisis.

A hugely successful European Championship (if not for the French team) also had an unquantifiable knock-on feel good effect. The second half of the year has seen a slight pick-up in employment and growth. But above all, it is low interest rates that have been the wind to the sails of the French property market.

Interest rates at historic lows

18 months of consistently decreasing rates ended with a small rise in November. In October, they were under 1% for 15-year loans, with 25-year loans seeing rates of around 1.4%. This climate has been auspicious for buyers who have been taking advantage of cheap credit, and for sellers who have been able to offload quickly.

Even in places with the fastest price growth (Paris, Bordeaux etc.), purchasing power is up. In the capital, €1000 of monthly mortgage payments will get you, on average, 25.2 m2, up from 23 m2 at this point last year, despite a 6% price jump in that period.

The average time from posting to selling in Paris is now two months, down from three to four months in the last few years. And the average difference between asking and final price is now -4.4%, falling nationwide for the first time ever, in November. Sellers anticipating higher rates have been even more eager to offload properties and replace them while they can finance cheaply.

With the number of potential buyers reaching its highest point since 2011, transaction numbers are soaring. The sales volume of older properties in Paris is up 11% in the past year. Undeniably on the right track, real estate sales in France are nevertheless highly dependent on the attractive mortgage rates. Sources are already predicting further interest rate increases, and potential buyers would be wise to secure the current interest rate for future purchases. Locking in the currency exchange rate is also a possibility. MoneyCorp, a Paris Property Group currency exchange partner has been advising clients to hedge the exchange rates, in some cases netting big gains. Clients who shorted the dollar prior to the US election for example, have improved their position by more than 10% since summer rates.

The healthy market activity has also impacted the rate of new construction. Sales of new construction is up over the past year, with building permit issuance up by 14.8%. Apartment building construction specifically has gone up even more, with the launches of new projects increasing by 20.3% over the last year and 10.3% over the last three months.

Looking ahead

French election years historically see a fall in transactions, but interest rates have never been this low. And the favorite to win in 2017, Francois Fillon, has promised a substantial liberalisation of the housing market: no rent caps, more flexible leases and easing construction regulations. Not to mention raising the threshold for social housing, pushing more into the private market. Other policy changes being proposed, including a tax exemption for capital gains after 15 years (rather than 30 years) and reduced notaire fees could cause a flux of properties for sale or attract investors. All this would be positive for property owners in France, and probably for tenants too.

On the other hand, if we can be certain about one thing, it’s that interest rates will not see the lows they did in 2016. Rises were recorded among some lending institutions, albeit incremental amounts. But don’t panic: a big jump is highly unlikely in 2017. Low rates have, for better or worse, become the norm, and banks will be wary of losing out on business to competitors by raising too much or too fast. Rates are predicted to go up steadily (rather than suddenly) throughout 2017, or at the latest in 2018/2019. This would be prompted by the Central European Bank, worried that low interest rates could hurt banks in the long-run.

All in all, the notaires predict that 2017 is going to be a very good year for real estate. In Paris, prices are expected to increase steadily over the next few months, with the Notaires de Paris predicting a 6% increase in prices in January 2017.

Price fluctuations in France since 2008

Then there is Brexit, the course of which will become clearer by the end of March. Its effect is hard to gauge, but the general sentiment is: bad for Britain, thus good for France and French property prices. Anything more precise than this is conjecture. Slows in price growth in the UK (with France’s speeding up) since June 23 can also be put down to a hike in stamp duty.

In the US, the aftermath of Trump’s election saw the French government’s cost of borrowing double, which has already been felt in mortgage rates. Some observers predict a diversion of investment from America to Europe, which the French property market will gain from, but this remains to be seen.

Whatever 2017 holds in store, the prospects look good overall. Rates will remain low, and price growth in the capital shows no signs of slowing, while the rest of the country is also performing well. An uptick in economic growth and employment will certainly help the cause, but all things remaining equal, the momentum is with the market.

Considering all of these factors, now and the next few months appear to be the ideal time to secure a property purchase in France, particularly one with a euro mortgage. Regardless, 2016’s real estate growth foreshadows a promising 2017, and many interesting things to look forward to.

Image: Wikipedia

Contact Paris Property Group to learn more about buying or selling property in Paris.