Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

PPG Why you should make a claim against social charges paid on capital gains tax

The French government has reintroduced extra capital gains taxes on property sold in France by non-residents, using a not so subtle legal subterfuge that may well be contested by the European Court of Justice in coming months.

The issue of capital gains overpaid by non-resident property sellers in France has been a widely disputed issue, and one extensively covered by Paris Property Group, since the European Court of Justice (ECJ) ruled at the start of last year that foreign property sellers were being overcharged.

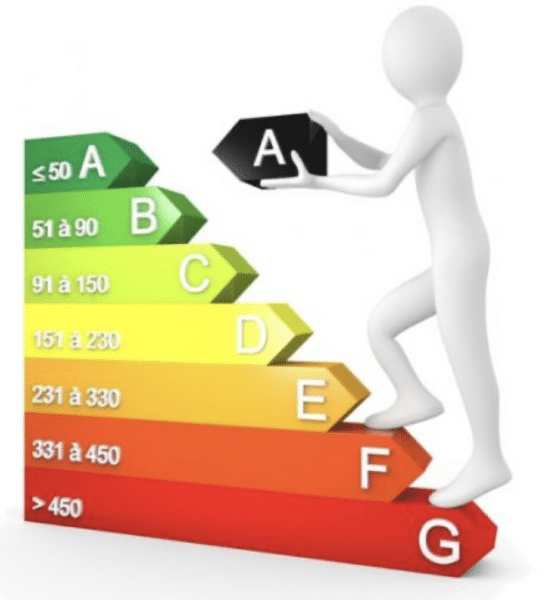

To recap briefly, since 2012 non-resident property sellers have been made to pay 15.5% tax in “social charges” on top of the usual 19% capital gains tax — resulting in a 34.5% tax. These social charges funded the sécurité sociale, the French insurance system non-residents do not benefit from.

This measure was contested by the ECJ which ruled on 26 February 2015 that making non-residents contribute to social charges they would not benefit from was unlawful. The French Supreme Court confirmed this ruling on 27th July 2015. This resulted in non-residents who sold property since 2012 being able to claim back the social charges they paid.

However, the Finance Ministry has now found a way of continuing to collect the full 34.5% capital gains tax as of January. The new 2016 Finance law provides for the 15.5% in “social charges” paid by property sellers to be transformed into a contribution to the Fonds de Solidarité Vieillesse, the national pension fund.

In an article entitled “Le tour de passe-passe de Bercy pour continuer à taxer les non-résidents” — “The Finance Ministry scheme to continue taxing non-residents” — French newspaper L’Opinion explains the motives behind this move: the extra 15.5% tax is expected to represent over 300 million euros per year flowing into the country’s coffers. Another article by the same paper reckons the Ministry is playing for time, knowing that even if this measure doesn’t work and non-residents end up needing to be reimbursed, it will be an issue for the next government to deal with.

In fact, this ploy to sidestep the ECJ’s ruling and continue to collect extra tax from non-resident property sellers has been deemed unacceptable under European Union law and is expected to be challenged by the ECJ. It is advisable to make a claim against these charges, as the French government will potentially have to reimburse millions of euros to non-residents in the future.

Non-residents can still claim back social charges paid on property sold between 2014 and 2015. A previously posted article by Paris Property Group covers how sellers can register a claim for social charges paid on capital gains in France.

Photo credit: Wikimedia / Europa credito

Contact Paris Property Group to learn more about buying or selling property in Paris.