Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

French shopping mall company Klépierre is set to buy Dutch competitor Corio, giving it Europe-wide coverage and €21 billion of assets

French real estate firm Klépierre is poised to acquire Dutch rival Corio for €7.2 billion. Following the deal, the Europe-wide shopping mall operator would have €21 billion of assets.

The deal is subject to acceptance by Corio’s shareholders. If approved, it would represent the largest transaction in the European retail real estate sector in almost a decade.

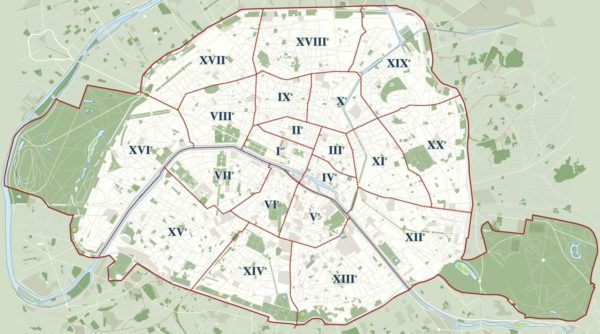

The enlarged company would also have more comprehensive coverage in Europe, notably in Germany and Italy. It would operate 182 shopping centers in 16 countries across Europe.

The merger is backed by Corio’s largest single shareholder, the Dutch pension fund ARG, which has a 30.6% stake. Klépierre’s two largest shareholders are also backing the deal: French bank BNP Paribas, with a 21.7% stake, and U.S. real estate company Simon Property Group Inc. (29.4%).

David Simon’s Simon Property Group owns a retail real estate empire in the U.S. It bought a controlling stake in Klépierre in 2012 and proceeded to rationalize its portfolio and streamline its operating practices. In 2014, Klépierre sold 126 malls in France, Italy and Spain to French supermarket company Carrefour for around €2 billion.

The Simon Property Group has followed a strategy of expansion into Europe, where it saw the potential in a market that was less mature than the U.S. shopping center business. The group has consolidated Klépierre’s position in the market and refocused it on the higher end retail sector.

Contact Paris Property Group to learn more about buying or selling property in Paris.