The Fall Calculation: Three Market Forces Favoring International Buyers

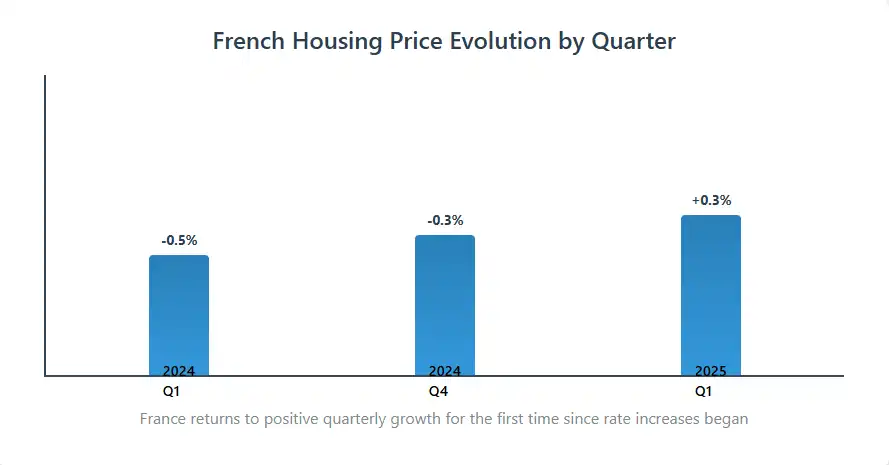

The first quarter of 2025 delivered a surprise that few international investors saw coming. For the first time since interest rate chaos began, France joined Belgium and Germany in posting positive annual price growth—a turning point that’s reshaping how individual investors and wealth managers view European real estate.

But here’s what the headlines missed: this wasn’t just another data point in a market recovery. The fundamentals driving international investment decisions have shifted decisively in favor of Paris property buyers, particularly those operating from outside France. The real question isn’t whether the recovery has legs—it’s whether there is still a gap between perception and reality.

What Does Improved Affordability Actually Mean?

The math has changed, and not just for French buyers. Domestic purchasers gained about 10 square meters of buying power resulting from reduced rates compared to last year, international buyers face a more complex but potentially more rewarding calculation. Current pricing in France is €3,020 per meter square and €9,500 per square meter in Paris with Q1 growth holding steady at 0.3% in France overall and 0.3% to 1% in Paris (depending on the source) —the kind of measured increase that suggests substance over speculation.

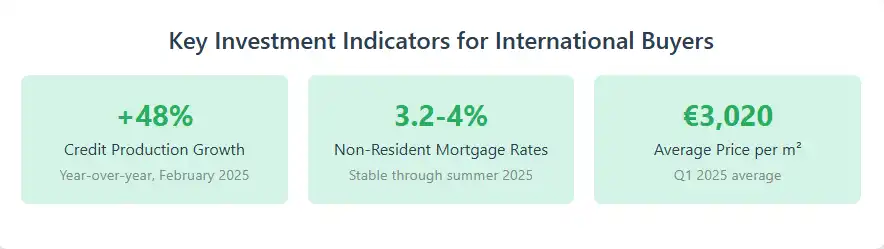

Here’s where it gets interesting for non-residents: while French residents can access mortgages around 3.1%, international buyers are typically looking at rates around 3.5% to 3.8%—still remarkably competitive given that US 30-year mortgages are running 6-7%. More significantly, these rates have held stable through the summer after declining in early 2025, giving overseas buyers time to plan without the usual urgency that characterizes volatile markets.

Are Credit Conditions Finally Working in Your Favor?

The credit picture tells a story that goes beyond the 48% surge in French housing loans this February. What matters for international buyers is that French banks are actively competing for non-resident business, even as lending tightens elsewhere in Europe. Yes, you’ll need 25-30% down compared to the near-100% financing sometimes available to French residents. And yes, the paperwork gets more involved when your income comes from New York or London or Singapore.

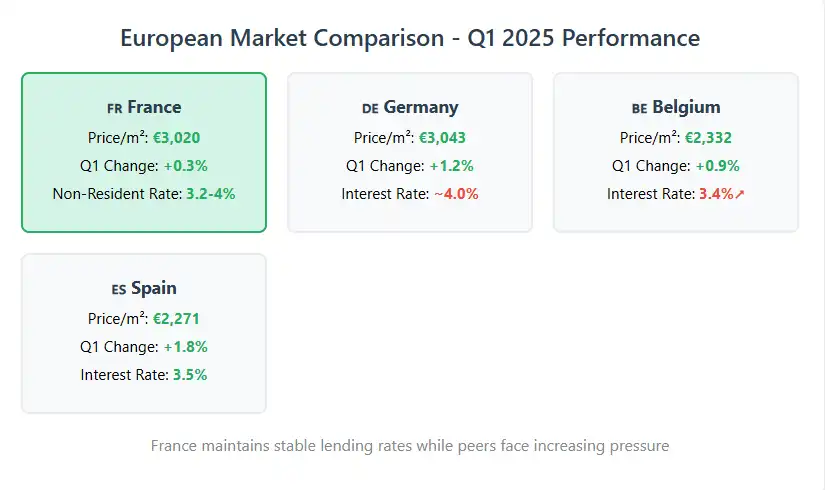

But consider the alternative: where else can non-EU buyers lock in sub-4% rates for up to 25 years? German banks are pushing toward 4% and getting pickier about foreign income. Belgian lenders are raising rates and adding restrictions. France, meanwhile, has maintained the kind of stability that makes CFOs and family office managers comfortable committing serious capital.

Why Paris Stands Apart from Other European Capitals

Walk into any European real estate conference these days and you’ll hear the same conversations: German buyers worried about rising rates, Belgian investors facing new restrictions, Spanish markets overheating again. Paris sits apart from this noise. The numbers back up what professionals have been quietly observing—France has managed its recovery with the kind of methodical precision that investors appreciate.

While other markets swing between euphoria and anxiety, Paris property has returned to January 2022 price levels without the drama. No speculative frenzies, no panic selling, just the steady progression of a market that functions according to economic fundamentals rather than sentiment.

What the Fall Season Might Bring

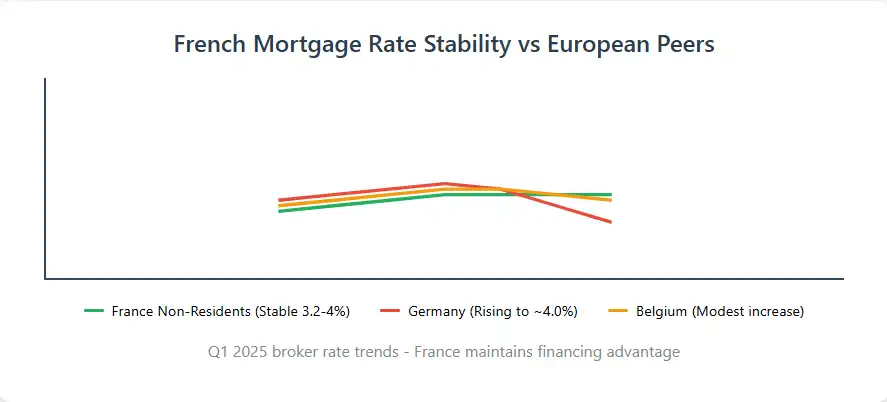

After declining through the first half of 2025, French mortgage rates have plateaued over the summer—not rising like their German counterparts, but not falling further either. This stability creates an interesting dynamic heading into fall, traditionally a secondary buying season but increasingly active for international purchasers who prefer to avoid spring’s competition.

The question hanging over autumn markets is whether this rate stability can persist. Bond yields across Europe remain elevated, and while the European Central Bank has shown restraint, global pressures continue building. For non-resident buyers, this suggests a window rather than a permanent condition. Those rates between 3.2% and 4% that look so attractive compared to home-country alternatives may not stay put indefinitely.

What makes fall 2025 particularly compelling is the convergence of several factors: summer’s rate stability providing planning certainty, continued credit availability for qualified international buyers, and pricing that hasn’t yet reflected the full impact of improved market conditions. “We’re seeing international clients take a more strategic approach this fall,” adds Paris Property Group founder Miranda Junowicz. “They’re not rushing to beat rate increases anymore—they’re taking time to find the right property at current pricing before the broader market catches up to what the fundamentals are telling us.” Unlike spring’s seasonal rush, fall buying offers time for thorough due diligence without the pressure of competing offers on every attractive property.

Contact Paris Property Group to learn more about buying or selling property in Paris or to be introduced to a trusted mortgage professional.

Social Cookies

Social Cookies are used to enable you to share pages and content you find interesting throughout the website through third-party social networking or other websites (including, potentially for advertising purposes related to social networking).