Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

Real estate: Purchasing power in France at its highest level since 2002

Falling interest rates have succeeded in offsetting a rise in prices, even in large cities where housing is becoming increasingly expensive.

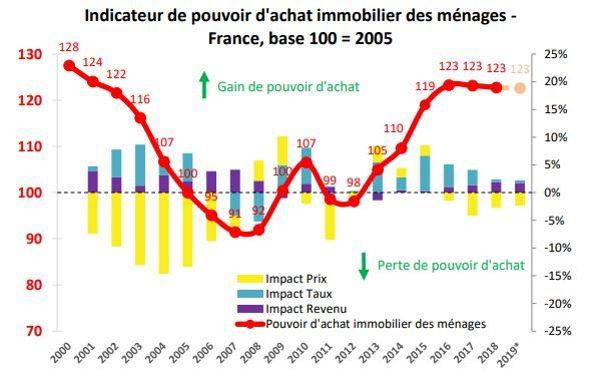

Who would have thought? While prices continue to rise, purchasing power in France has never been higher, at least not since 2002, according to the National Federation of Real Estate (Fnaim). Buyers can thank Mario Draghi, President of the European Central Bank (ECB), who will soon be replaced by Christine Lagarde, current Managing Director of the International Monetary Fund.

Thanks to the ECB’s accommodative monetary policy, borrowers benefit from extremely low credit rates: with all maturities combined, they now stand at 1.29% on average (against 1.44% in December 2018), according to the Observatoire Crédit Logement/CSA. This rate is almost equivalent to that of inflation, which was 1.2% as of June 30th, 2019. In other words: if you borrow at a rate of less than 1.2%, you will eventually increase your wealth by taking on debt. “We are seeing these rate cuts across all durations and buyer profiles,” says Maël Bernier, of brokerage Meilleurtaux. As such, over 20 years, the average buyer can obtain a rate of 1.36%, while excellent buyer profiles can secure a rate of 0.93%, a difference of 43 basis points. This difference is almost equivalent to that for 25-year loans: 1.57% for average profiles and 1.12% for the best profiles. “We are probably not yet at the lowest level,” says Maël Bernier.

Real Estate Purchasing Power Indicators for French Households

2019 estimates. Source: Banque de France, FNAIM, INSEE.

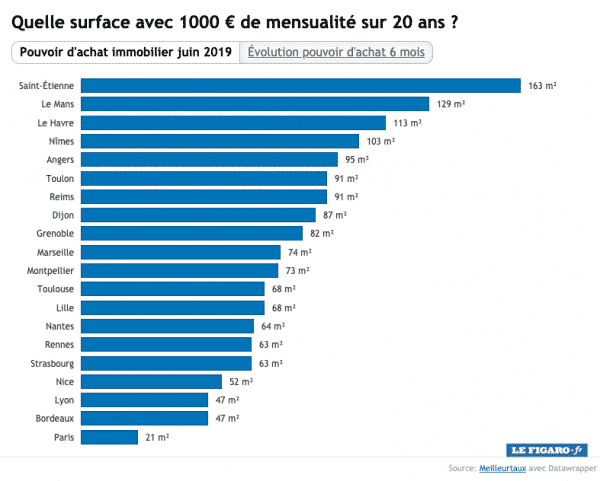

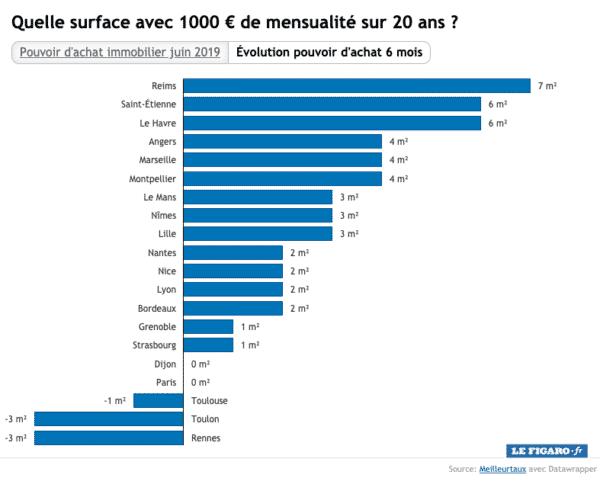

This is great news for major cities where prices continue to soar (Nantes, Lyon, Paris, Toulouse…). But is this drop in rates enough to compensate for soaring price increases? The answer is yes, according to the latest study by Meilleurtaux. Of the eleven most populous cities in France, only two have witnessed the purchasing power of their residents, or the area in m² that a buyer can expect to acquire with a mortgage of €1,000/month over 20 years, decline in the last six months. These cities are Toulouse (-1 m²) and Rennes (-3 m²). In Paris, purchasing power has remained stable, an admirable performance in spite of the sharp rise in prices. It is in Marseille and Montpellier that purchasing power has increased the most (+4 m² for both cities).

Purchasing Power in June 2019

Evolution of Purchasing Power over 6 Months

The situation is even more apparent in medium-sized cities where prices are falling (Mulhouse, Le Mans, Clermont-Ferrand…). As a result, cities such as Reims, Saint-Étienne and Le Havre have witnessed purchasing power increases between 6 and 7 m², about the same size as a large kitchen. “Today, the balance (between price increases and interest rate decreases) is good,” says Jean-Marc Torrollion, President of the Fnaim, “but it seems that the ‘rate effect’ has reached its limit. Let’s hope the ‘price effect’ does not take over”. This could weaken household creditworthiness.

Source: Immobilier: le pouvoir d’achat des Français au plus haut depuis 2002

Cover Photo: flickr, Shaun Garrity, Streets of Paris CC BY 2.0

Contact Paris Property Group to learn more about buying or selling property in Paris.