Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

Is it time to run for the hills? Could Trump and Brexit have created a perfect storm in which to buy that dream place in France?

Political uncertainty isn’t often cause for celebration but if you are looking to buy in France in particular, the next few months could be a great time to put in that offer, with a euro mortgage as your ‘Trump’ card.

Admittedly, at first glance this seems a strange tactic! First there was the unexpected UK referendum result that sent shockwaves through the Eurozone and beyond.

Sterling took a tumble against the Euro and has been fluctuating ever since. For UK buyers, this has meant that the relative sterling cost of your dream French home has increased by around 17% on this time last year. With further political uncertainty on the horizon exchange rate fluctuations are likely to continue in the medium term.

On the surface, Trumps’ victory shouldn’t materially affect the house prices in France. But looking at the US, we can see that the surprise result of the US election has led to a swift and sharp increase in government bond yields. These yields have a direct impact on US mortgage rates, with some US brokers reporting an average increase of 0.37% on fixed-rate mortgages. Further, the Euro / Dollar currency exchange rates are currently below $1.06 – the lowest level in more than a year – about a 10% improvement in purchasing power since this summer.

In terms of political uncertainty there are European elections in Germany, France and Holland next year, a referendum in Italy before this year end. Furthermore all have far-right or ultra-conservative candidates playing on the Trump-win to raise their profile and win over voters, a major upset in any of these countries could have real-estate ramifications with inflation and potential increases in borrowing costs.

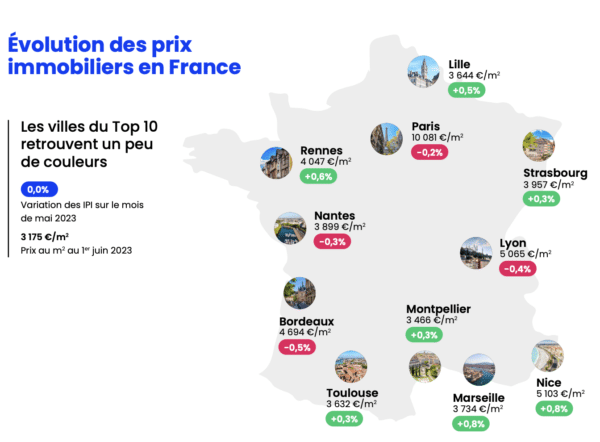

Yet, for all this uncertainty, canny buyers will take advantage of the new economic climate before it’s too late. According to the latest notaire figures, property prices in France are drifting higher in Paris, but lower elsewhere in France, with some departments having reporting falls over two or more consecutive quarters.

Couple that with the fact that currently French mortgage rates are at an all-time low with some lenders offering 10 year fixed rates deals for as little as 1.00 %* and variable tracker from 2.00%*. These low borrowing costs largely off-set the currency fluctuations for UK buyers.

If you are thinking about purchasing a second home in the near future and with the French elections only six months away, it could be prudent to get an approval in principle with the bank in case the rates follow the pattern set recently in the US and rise quickly. Moreover, a euro mortgage provides protection against the current exchange rate fluctuations and can even save you money compared to a cash purchase.

In a recent article for the Sunday Times, International Private Finance’s client Rob Royle has done just that. By taking out a €125,000 mortgage instead of using his sterling savings to finance the purchase, Rob hopes to save over £17,000 by paying back the mortgage once the exchange rate recovers. Plus, with such attractive fixed-rate deals on offer, these mortgages also offer great piece of mind as they, by their very nature, protect purchasers from any interest-rate hikes in the future.

Certainly, the real estate market has been strong – with Paris, in particular, seeing robust demand from non-residents. IPF itself has seen a 250% increase in enquiries from cash buyers looking to take advantage of the record low mortgage rates to borrow in Euros.

So it would seem that there is a silver lining to all this market uncertainty.

To find out how to take advantage of the current financing and currency exchange opportunities to secure your dream property in Paris, email us at Contact@ParisPropertyGroup.com

Content adapted from International Private Finance

Contact Paris Property Group to learn more about buying or selling property in Paris.