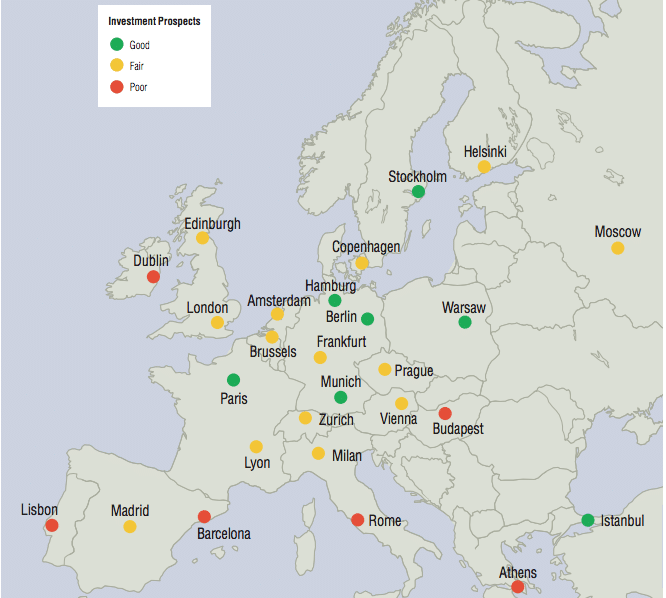

Expert Insight, Breaking News, and Insider Stories on Real Estate in Paris

Paris Ranked Best in 2012 Urban Land Institute Investor Survey for Real Estate Investment in Europe

Paris is the sixth-most-favoured market overall, and its retail, office, and hotel sectors are highly rated by investors looking for acquisitions. Investors reported that Paris and London offered the best opportunities in 2012. “The market has scale, liquidity, a reasonably protected legal framework, and a diverse range of tenants.”

Although it was frequently ranked with London as the region’s top market, Paris was considered as more attractive by some because it is less dependent on the financial sector. “When I compare London to Paris, the first thing is that London is stretched and the market is more volatile. Real estate cycles are more pronounced in the U.K. capital.”

Although it was frequently ranked with London as the region’s top market, Paris was considered as more attractive by some because it is less dependent on the financial sector. “When I compare London to Paris, the first thing is that London is stretched and the market is more volatile. Real estate cycles are more pronounced in the U.K. capital.”

Contact Paris Property Group to learn more about buying or selling property in Paris.